20240328_2105UTC

Attended CC on 20240328_1300UTC

First I want to thank everyone for pushing the CC forward an hour and putting up with me!

This has been an exciting week for myself and interest protocol. So lets get the housekeeping out of the way.

First my votes:

Proposal 51

February Delegate Program Administration Expenses - supported.

Proposal 52

To List aUSDC As Un-Capped Collateral On The Optimism Deployment Of Interest Protocol - supported

So some background on Proposal 52. I was probably the first user of this facility. Quick summary I found a moderate problem with the uncapped aUSDC facility. This proposal hopefully will fix the issue I found relating to how much aUSDC the protocol reported I had, vs. how much I had deposited. Let’s just say over time these matched less and less in a way not favorable to the user. devs assure me the additional aUSDC are still there, but they are inaccessible to me. We still need to see the post mortem on what caused this bug, but long story short there still is aUSDC I deposited in the capped collateral still living somewhere in the protocol (presumably the capped contract).

Now to more important news for the protocol and everyone.

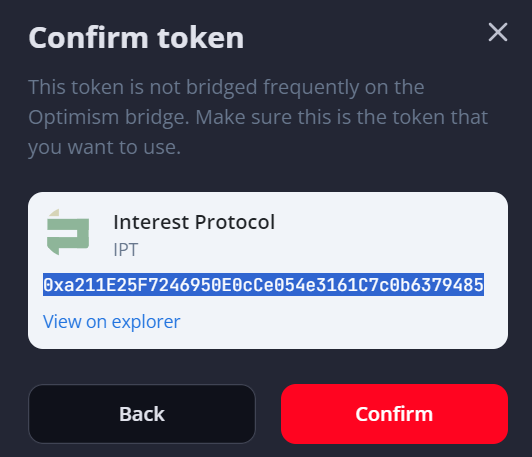

- IPT is now Whitelisted on Velodrome on Optimism

What this means is that interestprotocol bridged L1 IPT now trades on Velodrome via an incentivized Velodrome v IPT:USDC .3% Uniswap v2 like Liquidity Pool.

The tasks I have done here:

- IPT Whitelisted on Velodrome so it can be used in liquidity positions

- IPT tradeable on Velodrome

- Bridged about 600K IPT via my IPTMan.eth delegate wallet.

- IPT:USDC .3% v2 LP initialized and filled with approximately 9.2K USDC(native) against 210K IPT - initial price was about .041

- IPT was whitelisted for Velodrome LP gauge(s) I focused on one gauge IPT:USDC 0.3% fee v2 LP. What this means is that IPT can formally incentivize (bribe) pools with tokens

- I bribed with 10K IPT worth at time $476). We received approximately 460K veVELO votes (about .0469% of the total vote).

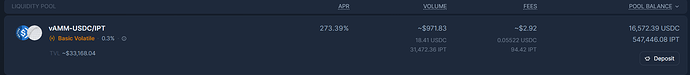

IPT:USDC pool LP and rewards APR as time of writing:

Link to above pool and Velodrome on optimism.

Emission value for the $476 (10K IPT value of bribe) will lead to approximately 5000 VELO (worth about $1.7K) to the pool. Current APR 272% or .745%/day. This will vary with VELO price (the $$ value of emissions) and the APR will vary with both VELO and IPT price.

The point here is we got some luck and our bribe cost to emissions value (bribeROI) is 1700/476 =3.57 (we get $3.57 for every $1 of vote incentives/bribes). Velodrome has a $OP grant to incentivize native USDC pools so we ‘should’ get some level of $OP matching incentives next epoch. So if we maintain this $500 value of IPT or other bribe incentives - combined with matching $OP we should get the same or more VELO emissions next epoch (epochs are weeks).

- I purchased about 10.5K VELO and locked this in a veVELO NFT to vote for the IPT:USDC pool (I had a concern no-one would vote for the pool but turned out another 450K of votes voted to claim the bribe incentives).

- Because I purchased part of the GFX IPT lost in the distribution contract it is my goal to use 100K IPT of the IPT I purchased to put up 10K IPT/epoch incentives for the next 10 weeks. I also have used something north of $12K of my own cash to pair with 210K of IPT with 9.2K of USDC to initialize the LP and buy the 10.5K VELO to lock in the veVELO NFT (now worth about 3.5K). I will account for this later. Because this all is being done with my own private funds, I don’t anticipate asking governance for a refund, and the details are public on optimistic blockchain I don’t intend to account for my activities here except to report to governance weekly in the forums basic activities related to incentivizing the pool, the emissions and activity in building IPT:USDC liquidity and trading(fees) on Velodrome for the community.

Anyone can bribe the pools, provide liquidity, and earn LP emissions in VELO. My intention is to leave my initial LP permanently and to over time claw back the USDC I spent by selling IPT to provide sell side liquidity should the IPT price rise. It is my hope that after 10 weeks that governance:

- Decides to hire/appoint a Velodrome IPT:USDC LP incentive ‘manager’

- Incentivize the pool with IPT

- Build a community owned IPT:USDC position and capture and recycle the VELO LP emissions to the bribe/incentive rewards.

- The details of who or how this is managed we have 2.5 months to decide and implement. I intend to manage this for next 10 epochs.

So InterestProtocol IPT is formally on the Velodrome Flywheel Lets try to be good Velodrome community members, and endeavor to build project marketcap in a slow and steady fashion for all interestprotocol stakeholders. So if you appreciate this work stop on over to Velodrome discord, say hi, and thank the Velodrome team (Alex and Dan) for their efforts to get us on the Flywheel!

To me this is a significant accomplishment that I am happy to see come to fruition. Often times I have ideas, it is rare that I am able to actually be on the front lines getting something accomplished. To be fair GFX devs getting IPT whitelisted on Optimism bridge was key.

Now to other important topics:

In all this work I found out USDC.e (Optimistic bridged version of USDC on Optimism) is being depreciated. If you go to optimistic bridge to bridge USDC you will be referred to superchain bridge that only bridges mainnet USDC to Optimism USDC ‘native’. Which means that interestprotocol using USDC.e vs. USDC.n(for native) is likely to be unusable at some point.

This means we need to think about spinning up another IP instance on Optimism that uses same collateral, but USDC.n vs. USDC.e as its liquidity source. @Getty and GFX devs are aware of this change. We won’t lose USDC.e immediately but it is clear to me circle is pushing for native USDC on various chains than sticking with bridged USDC.e

Other things.

Given that we may end up with more IPT:USDC liquidity on Optimism and increasing L1 gas prices and costs for delegates in the CC (and with a proposal) I am going to propose that we move IPT governance away from mainnet to Optimism. This should reduce delegate voting costs, and hopefully bring in new IPT owners to delegate IPT. @Getty and GFX developers in the CC indicated this will take some careful work, but ‘should’ be doable. Expect a formal proposal from me or GFX devs to propose this change IP governance from mainnet to Optimism

Similarly we discussed delegates and users being able to claim their IPT compensation/rewards on Optimism… - @Getty and GFX devs said there shouldn’t be too much problem spinning up a claim contract on optimism. We probably will need a proposal for this as well.

Based on discussions with Velodrome communities and users as well as Velodrome team itself - as well as comments from @Getty and GFX devs that it looks possible for interestprotocol to add Velodrome Slipstream (its v3 LP NFTs) assets as collateral within our protocol. This would be a pretty significant development on Optimism as well as the Velodrome community. It would be a first there and give us first mover advantage.

Requirements for such a facility are same as for Aura/Balancer and Uniswap assets.

- Must be able to stake the LP within the collateral contract and claim rewards

- protocol Value ideally should include not just the LP but also the claimable rewards

- UI really needs to show the NFT IDs and display the relevant LP and fees/rewards for claiming and withdrawal

The mechanics of these should mimic the Balancer LP Aura staking model interestprotocol has already developed. This will require significant testing (perhaps we could use the depreciating USDC.e IP instance for this before releasing to the USDC.n IP instance we spin up) idk will leave this to developers.

Right now the interest protocol UI for Uniswap v3 WETH:USDC doesn’t include the collectable v3 rewards, nor does the UI give ability for user to collect these without withdrawing the NFT. We need this all to be easy, intuitive, reliable and easy for users to use. I think some careful consideration of how we handle these mixed assets in liquidations (in terms of users setting order of liquidations) needs to be considered as well. While this feels daunting from a development perspective I think if interestprotocol wants to succeed and thrive we need to not just be ahead of everyone, but we need to do it ‘well’.

I think this is an exciting time for interestprotocol, and our window to take advantage here is narrow. If we can execute we leapfrog quite a bit of development going on and can become a leader, and a better known and used protocol than a protocol no-one knows about and is barely used.

Final thing to consider and less important than the above tasks:

Spinning up a USDC.n liquidity based IP instance on Base Given that base and Aerodrome is so hot, whatever we do with Velodrome on Optimism I am pretty sure this could all port very easily to base (just change token and contract addresses). Given we would have the only protocol that could take slipstream collateral (both Aero (coming very soon) and Velodrome - now) we could get additional attention and users via base.

That is all for my Delegate report this month.

![]() so it failed. I think this illustrates a kind of governance failure if one IP voter can make or break a proposal. Really would like to see these monthly payments go to more like a 3-6 month voting cycle and have a well defined governance cycle and maybe get a few more delegates on board here.

so it failed. I think this illustrates a kind of governance failure if one IP voter can make or break a proposal. Really would like to see these monthly payments go to more like a 3-6 month voting cycle and have a well defined governance cycle and maybe get a few more delegates on board here.