Proposal to add sfrxETH

Proposal to add sfrxETH as collateral to Interest Protocol.

Overview

ETH in the Frax ecosystem comes in two forms, frxETH (Frax Ether), and sfrxETH (Staked Frax Ether).

frxETH acts as a stablecoin pegged to ETH, so that 1 frxETH always represents 1 ETH and the amount of frxETH in circulation matches the amount of ETH in the Frax ETH system. When ETH is sent to the frxETHMinter, an equivalent amount of frxETH is minted. Holding frxETH on its own is not eligible for staking yield and should be thought of as analogous as holding ETH

sfrxETH is an ERC-4626 vault designed to accrue the staking yield of the Frax ETH validators. At any time, frxETH can be exchanged for sfrxETH by depositing it into the sfrxETH vault, which allows users to earn staking yield on their frxETH. Over time, as validators accrue staking yield, an equivalent amount of frxETH is minted and added to the vault, allowing users to redeem their sfrxETH for a greater amount of frxETH than they deposited.

The exhange rate of frxETH per sfrxETH increases over time as staking rewards are added to the vault. By holding sfrxETH you hold a % claim on an increasing amount of the vault’s frxETH, splitting staking rewards among sfrxETH holders proportional to their share of the total sfrxETH. This is similar to other auto-compounding tokens like Aave’s aUSDC and Compound’s cUSDC.

Parameters

Token Address: 0xac3E018457B222d93114458476f3E3416Abbe38F

LTV: 75%

Liquidation incentive: 10%

Maximum Cap: 5,000 (~$7,500,000)

Primary oracle Address: 0xd2F0fa7f2E6a60EEcf4b78c5b6D81002b9789F2c

Primary oracle: SfrxEthFraxDualOracle (Chainlink + Curve EMA & UniV3 TWAP)

Secondary oracle: 0xa1f8a6807c402e4a15ef4eba36528a3fed24e577

Price deviation: Curve frxETH/ETH pool + sfrxETH ERC4626 share price

Liquidity

sfrxETH Market Cap: $72.8M

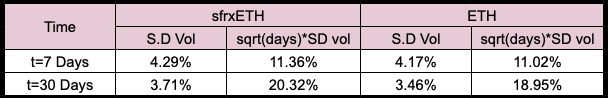

sfrxETH Volatility:

frxETH Market Cap: $143.7M

frxETH Curve Liquidity: $122.61M

frxETH Solidly Liquidity: $3.08M

frxETH Uniswap V3 Liquidity: $996.99K

frxETH Coingecko 7-day avg. volume: $676.6K

Notable Exchanges: Curve, Solidly, Uniswap V3

Technical Risks

Type of contract: ERC-4626 vault

Underlying asset: frxETH

Time: 73 days

Value: The original amount of frxETH deposited plus staking rewards accrued over the duration of the period the tokens were deposited.

Relevant References

Website: Frax Finance

Documentation: frxETH and sfrxETH - Frax Finance ¤

Analytics: Frax Facts

Ethereum contract address: https://etherscan.io/address/0xac3e018457b222d93114458476f3e3416abbe38f

Audits: Code4Arena

Bug Bounty: 10% of the total possible exploit or $10m worth paid in FRAX+FXS (evenly split).

Communities:

- Telegram: Telegram: Contact @fraxfinance

- Discord: Frax Finance

- Governance Discussion: https://gov.frax.finance

- Governance Voting: Snapshot

- Twitter: https://twitter.com/fraxfinance