Proposal to add LDO

Proposal to add LDO as a capped collateral to Interest Protocol.

Overview

The LDO token is the governance token to Lido Finance and their popular stETH product which listed on Interest Protocol.

The proposed parameters and cap are purposely very conservative. After the initial listing, a subsequent proposal could increase the cap.

Parameters

Token Address: 0x5a98fcbea516cf06857215779fd812ca3bef1b32

LTV: 70%

Liquidation incentive: 10%

Cap: 4m (~$5m)

Oracle Address: [To be deployed]

Primary oracle: Chainlink LDO/ETH

Secondary oracle: Uniswap v3 LDO/ETH

Price deviation: 20%

Liquidity

MCAP: $878m

Uniswap v3 liquidity: $8m

Coingecko 7-day avg 24hr volume: $14m

Notable exchanges: Binance, Okex, Uniswap, FTX

Technical risks

- Type of contract: governance token

- Underlying asset: governance token

- Time: 667 days

- Value: control of the Lido Finance and their Staked ETH product

- Privileges:

- The controller (Lido Aragon Token Manager) can mint & destroy LDO tokens

- The enable/disable transfer of LDO tokens

- Upgradability: None

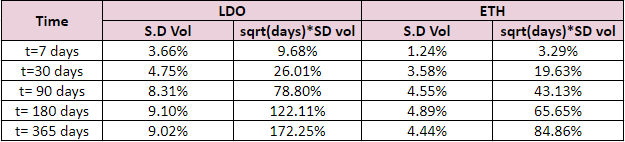

Volatility Data

The below shows the volatility of LDO relative to ETH