Proposal to add DYDX

Proposal to add DYDX as a capped collateral to Interest Protocol.

Overview

The DYDX token is the governance token to the dYdX Exchange. The DYDX token’s governance system is compatible with Interest Protocol’s governance system. Users that post DYDX as collateral can maintain their voting power by delegating the voting power to another address.

The proposed parameters and cap are purposely very conservative. After the initial listing, a subsequent proposal could increase the cap.

Parameters

Token Address: 0x92d6c1e31e14520e676a687f0a93788b716beff5

LTV: 70%

Liquidation incentive: 10%

Cap: 3.3m (~$5m)

Oracle Address: [To be deployed]

Primary oracle: Chainlink DYDX/USD

Secondary oracle: Uniswap v3 DYDX/ETH

Price deviation: 20%

Liquidity

MCAP: $200m

Uniswap v3 liquidity: $800k

Coingecko 7-day avg 24hr volume: $69m

Notable exchanges: Binance, Okex, FTX

Technical risks

- Type of contract: governance token

- Underlying asset: governance token

- Time: 460 days

- Value: control of the dYdX protocol

- Privileges:

- The owner (the executor which is controlled by the governor) can mint additional DYDX tokens, but not for four years.

- The owner can transfer ownership of the contract to another address.

- The owner can renounce ownership of the contract, at which point no changes can be made.

- Upgradability: None

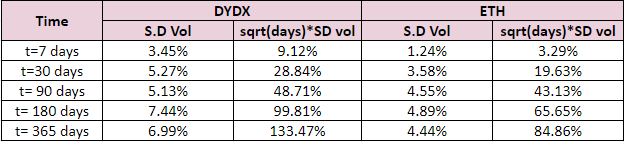

Volatility Data

The below shows the volatility of DYDX relative to ETH