Proposal to add cbETH

Proposal to add cbETH as a capped collateral to Interest Protocol.

Overview

The cbETH token is staked ETH managed by Coinbase. Each cbETH represents a staked-ETH. Similar to stETH, all stakes are currently locked until the next Ethereum upgrade.

Parameters

Token address: 0xbe9895146f7af43049ca1c1ae358b0541ea49704

LTV: 75%

Liquidation incentive: 10%

Cap: 4200 (~$5m)

Oracle Address: [To be deployed]

Primary oracle: Chainlink cbETH/USD

Secondary oracle: Uniswap v3 cbETH/ETH

Price deviation: 15%

Liquidity

MCAP: $1b

Uniswap v3: $5.37m

Coingecko: $16m

Notable exchanges: Coinbase, Uniswap, Curve

Technical Risks

Coinbase has taken measures to minimize the risk of slashing. However, slashing can be caused by events outside of our control that could lead to the loss of staked ETH. If you started staking prior to August 30, 2021, Coinbase will replace any ETH lost to slashing at no additional cost. If you started staking your ETH after August 30, 2021 or wrap your staked ETH for cbETH, some conditions apply—please see the User Agreement for details.

Coinbase

- Type of contract: Fiat Token Proxy (managed)

- Underlying asset: ETH

- Time: 284 days

- Value: IOU of staked ETH managed by Coinbase

- Privileges:

- The owner can can assign and change the “blacklister” role

- The blacklister can add & remove addresses on the contract’s blacklist. Blacklisted addresses are unable to transfer their balances.

- The owner can transfer the ownership of the contract

- The owner can upgrade the contract

- The owner can call updateMasterMinter

- The MasterMinter can add & remove minters on the contract

- The minter(s) can mint/burn more cbETH

- The owner can call updateOracle

- The oracle can call updateExchangeRate

- The owner can call updatePauser

- The pauser can un/pause

- A pause will halt all transfer & approvals

- The owner can call updateRescuer

- The rescuer can transfer erc20 tokens wrongly sent to the contract out

- Upgradability: Yes

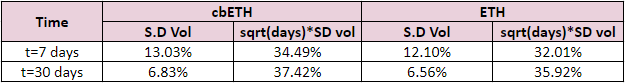

Volatility Data