Proposal to add BAL

Proposal to add BAL as a capped collateral to Interest Protocol.

Overview

The BAL token is the governance token of the Balancer Ecosystem. Users who vote-lock their tokens (BAL + wETH => veBAL) receive a share of trading fees from the platform as well as a boost on their provided liquidity. veBAL holders vote to determine how the BAL inflation schedule is distributed across the various liquidity pools.

The proposed parameters and cap are intentionally very conservative. After the initial listing, a subsequent proposal could increase the cap.

Parameters

Token Address: 0xba100000625a3754423978a60c9317c58a424e3D

LTV: 70%

Liquidation incentive: 10%

Cap: 770k ($3m)

Oracle address: [To be deployed]

Primary oracle: Chainlink BAL/USD

Secondary oracle: Balancer v2 BAL/WETH

Liquidity

Market capitalization: $248m

Circulating Supply: 36,146,883

Fully Diluted Supply (Max Supply): 96,150,704

Balancer v2 liquidity: $193m

Coingecko 7-day average 24 hour volume: $26.6m

Notable exchanges: Coinbase, Gemini, Binance, FTX, Huobi, HitBTC

Technical Risks

-

Type of contract: Governance Token

-

Underlying asset: Governance Token

-

Time: +800 days

-

Value: Control of the Balancer Protocol and its various deployments

-

Privileges: the owner of the BAL contract is the Balancer

Authorizercontract.- Balancer’s access control solution is the

Authorizercontract, which holds all permissions in the network, and is queried by other contracts when permissioned actions are performed. - The

BalancerMinteris granted permission by theAuthorizerto mint BAL (viaBalancerTokenAdmin, which enforces the minting schedule). The minting schedule has pre-defined upper limits. - ‘VotingEscrow’ is the veBAL contract, which allows LPs to deposit and lock 80/20 BPT in exchange for veBAL. veBAL holders own the governance rights to the Balancer ecosystem. The BAL token by itself has no influence over the ecosystem.

- Balancer’s access control solution is the

-

Upgradability: Yes

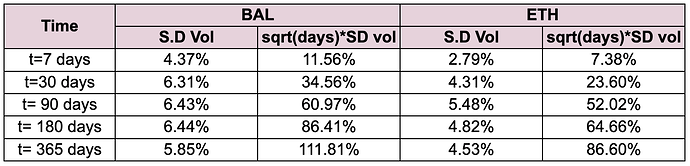

Volatility Data

The below shows the volatility of BAL relative to ETH.

The chart below (repurposed) shows the main Decentralised Exchange spot prices relative to the Chainlink Oracle feed.